Divorce Isn't Easy. You Don't Have to Face It Alone.

Experienced Guidance. Trusted Solutions.

Complimentary Consultations

Proven Track Record of Success

Focused on Compassion and Empathy

Request Appointment

Hero Request Form

Thank you for contacting us.

We will get back to you as soon as possible

Please try again later

Request Appointment

Hero Request Form

Thank you for contacting us.

We will get back to you as soon as possible

Please try again later

Decades of Experience in Georgia Family Law

Gentry Law Firm LLC, a team of exceptional divorce lawyers in Marietta, GA, is a distinguished family law firm with a strong focus on providing compassionate and empathetic legal services. With over 80 years of combined experience, our team of skilled attorneys is dedicated to delivering trusted solutions and experienced guidance to our clients. We specialize in handling complex divorce and custody cases and crafting customized legal strategies to meet the unique needs of each client.

We pride ourselves on being true partners to our clients, listening to their concerns, and guiding them through the often challenging process of divorce. Our honest, reasonable attorneys are prepared to fight for our clients' rights, but we always maintain respect for all parties involved. We have a proven track record of success and offer complimentary consultations. Call (770) 268-6384 or fill out our online form to schedule an appointment.

Why Choose Gentry Law Firm LLC?

Choosing Gentry Law Firm means choosing a team of seasoned family attorneys who understand the emotional toll of divorce. Our locally-owned practice places a special focus on women, helping them envision a brighter future beyond divorce. Our attorneys are compassionate, empathetic, and dedicated to providing a collaborative effort in every case. We believe in creating customized legal strategies that cater to the unique needs of each client. With us, you're not just another case number; you're a partner.

The attorneys at Gentry Law Firm are admitted to and have argued in the Georgia Supreme Court, the Georgia Court of Appeals, and the 11th Circuit U.S. Court of Appeals in Atlanta. We're a Bar member of the United States Supreme Court as well as the Georgia Bar and the Florida Bar. Over the years, we've also argued in the United States District Court for the Northern District of Georgia and the United States District Court for the Middle District of Georgia.

Contact us today for a complimentary consultation.

Complimentary Consultations

Over 80 Years of Combined Experience

Proven Track Record of Success

Focused on Compassion and Empathy

Locally Owned Since 1986

Professional Guidance Through Divorce

Hiring a Divorce Lawyer

Choosing the right divorce lawyer is a critical step in the divorce process. At Gentry Law Firm, we offer experienced guidance and a collaborative approach.

High-Asset Divorce

High-asset divorces can be complex, but our team is equipped with the knowledge and experience to handle these cases with precision and care.

Divorce Lawyers for Women

Our firm has a strong focus on supporting women through the divorce process, helping them envision a brighter, more secure future.

Division of Property

We understand the intricacies of property division in a divorce and work diligently to ensure a fair and equitable distribution.

Business Divorce

Our attorneys are skilled in handling business divorces, ensuring your professional interests are protected during the process.

Divorce for Doctors

We provide specialized services for doctors going through a divorce, understanding the unique challenges they face.

Alimony and Spousal Support

Our team is experienced in negotiating alimony and spousal support agreements, ensuring your financial stability post-divorce.

Legal Separation

We guide clients through the process of legal separation, providing professional support and advice every step of the way.

Grounds for Divorce

Our team can help you understand the grounds for divorce in Georgia, helping you make informed decisions about your case.

How to File for Divorce in GA

Our attorneys at Gentry Law Firm will take you step-by-step through the process of filing for divorce here in the Peach State.

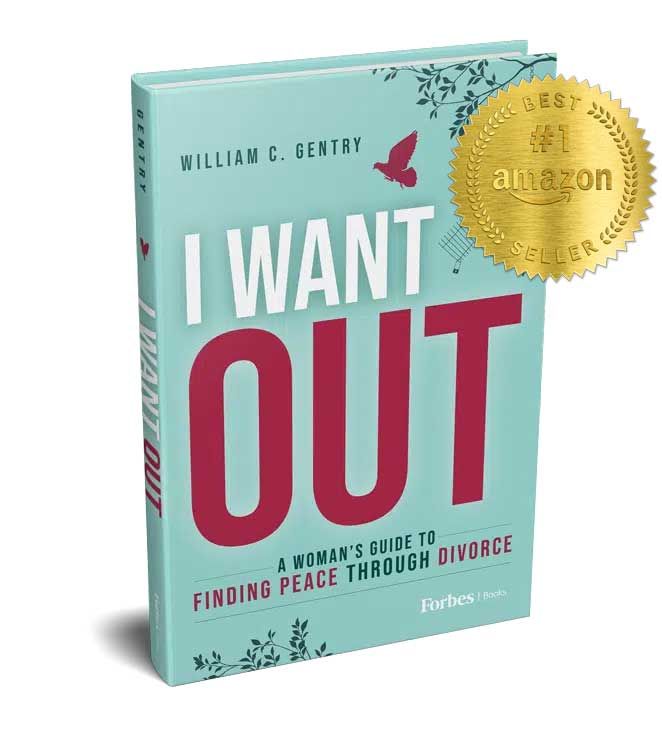

I Want Out:

A Woman's Guide to Finding Peace Through Divorce

Written By William C. Gentry

"William C. (Bill) Gentry has spent decades helping thousands of women through divorce, allowing them to pursue happier futures. This book is a collection of Bill's decades of legal experience and knowledge, providing a step-by-step breakdown of the divorce process.

I Want Out contains helpful anecdotes of divorce cases Bill has fought - and won - throughout his 37 year career. The guide dispels the rumors and misinformation that surrounds divorce to help clarify the process and empower you to take action in your own life."

Learn More About

Gentry Law Firm LLC

Located in Marietta, GA, Gentry Law Firm LLC specializes in divorce law and child custody and support. Proven track record of success. Over 80 years of combined experience. Focused on compassion and empathy. Call for a complimentary consultation.

serving area

Bartow County, GA

Cherokee County, GA

Cobb County, GA

Dekalb County, GA

Douglas County, GA

Forsyth County, GA

Fulton County, GA

Gwinnett County, GA

Paulding County, GA

and surrounding areas

Business Hours

- Mon - Fri

- -

- Sat - Sun

- Closed